We understand the tax system is complicated and can be difficult to navigate. Every small business owner and individual should have a trusted advisor or accountant that can assist them in navigating the complexities of the system. If you need assistance, we’re here to help.

Resources

The following are some common due dates. Generally, if your due date falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day.

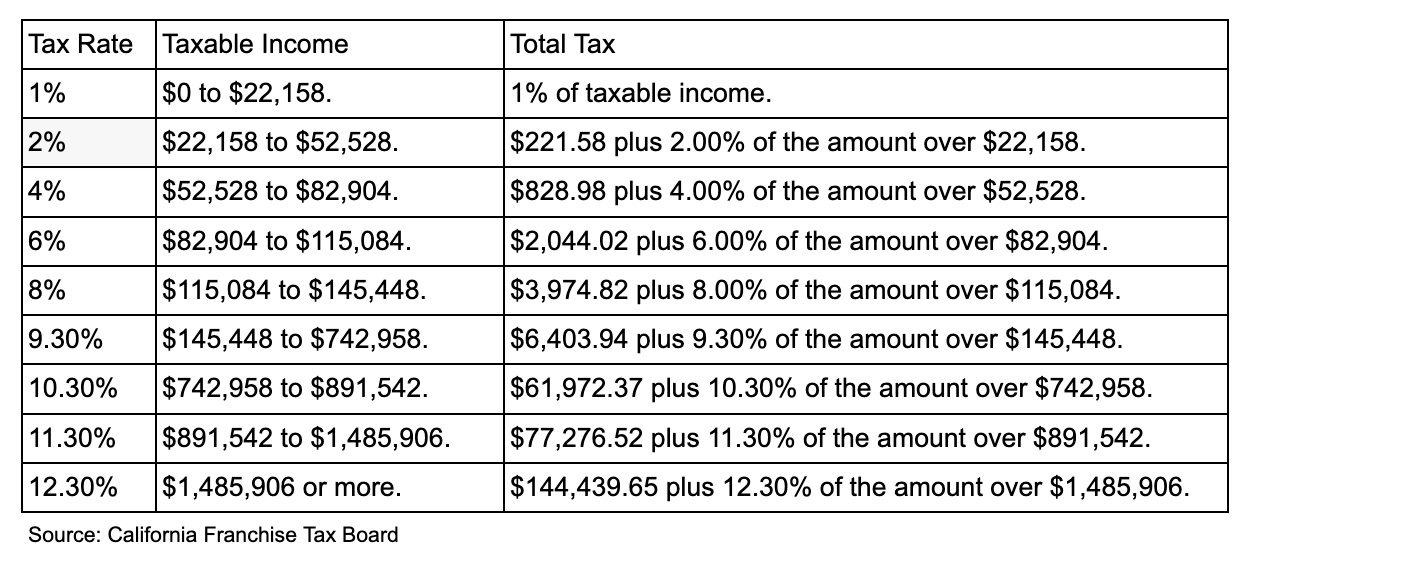

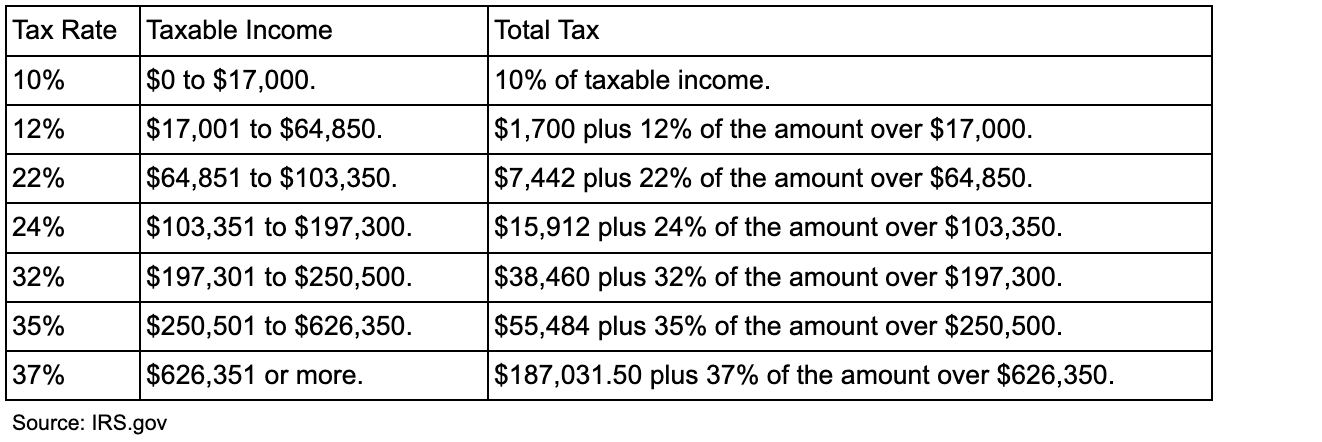

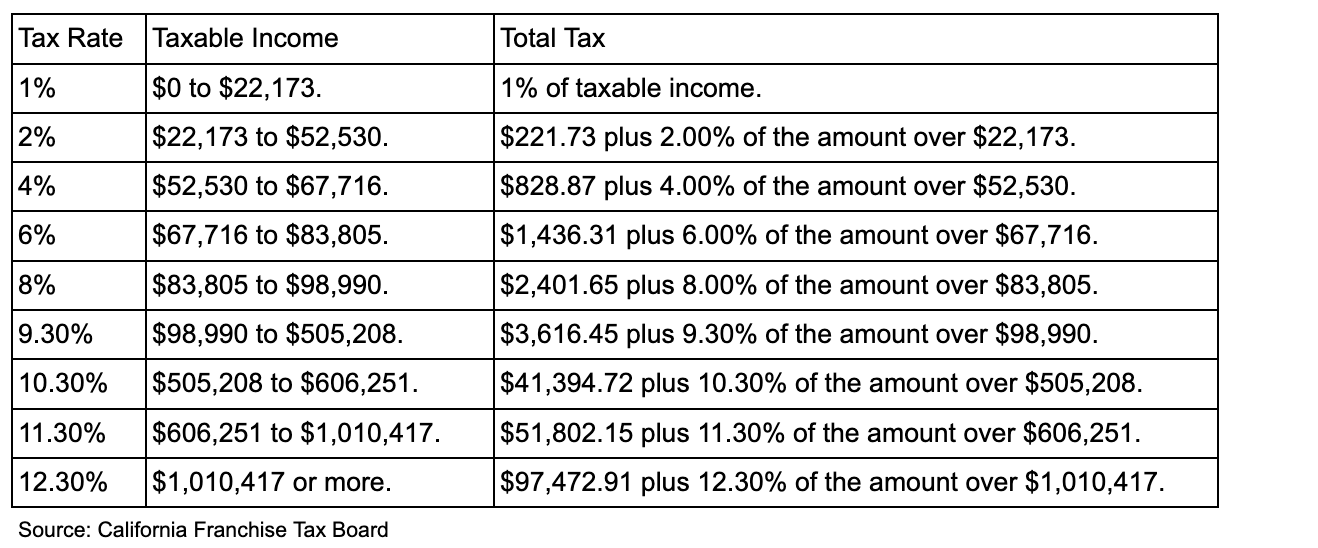

Tax Rates

Other Resources

Where’s my refund?

Financial Calculators:

Online Payments:

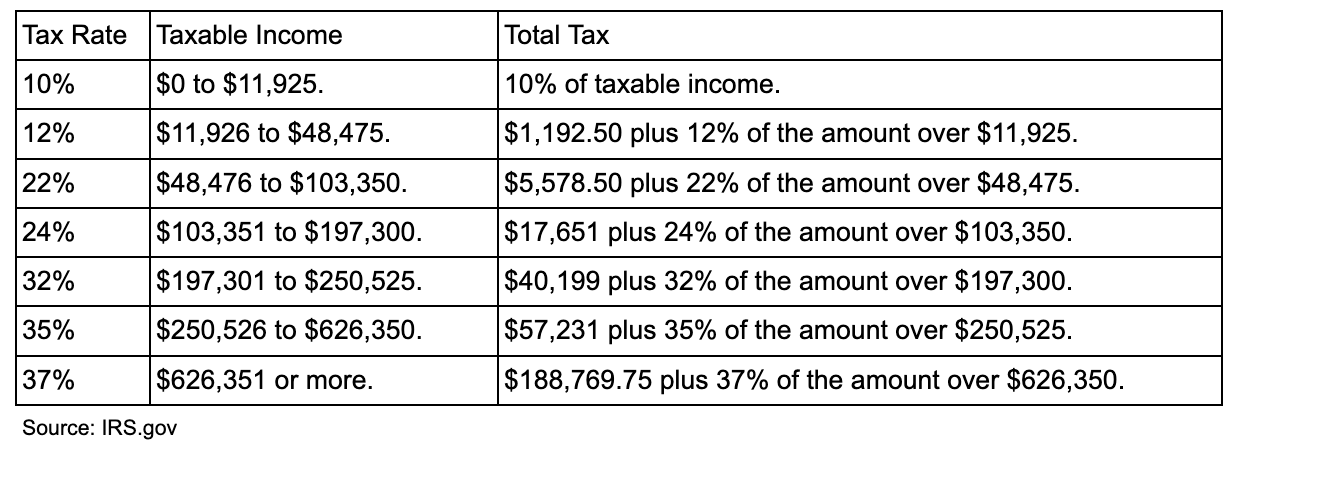

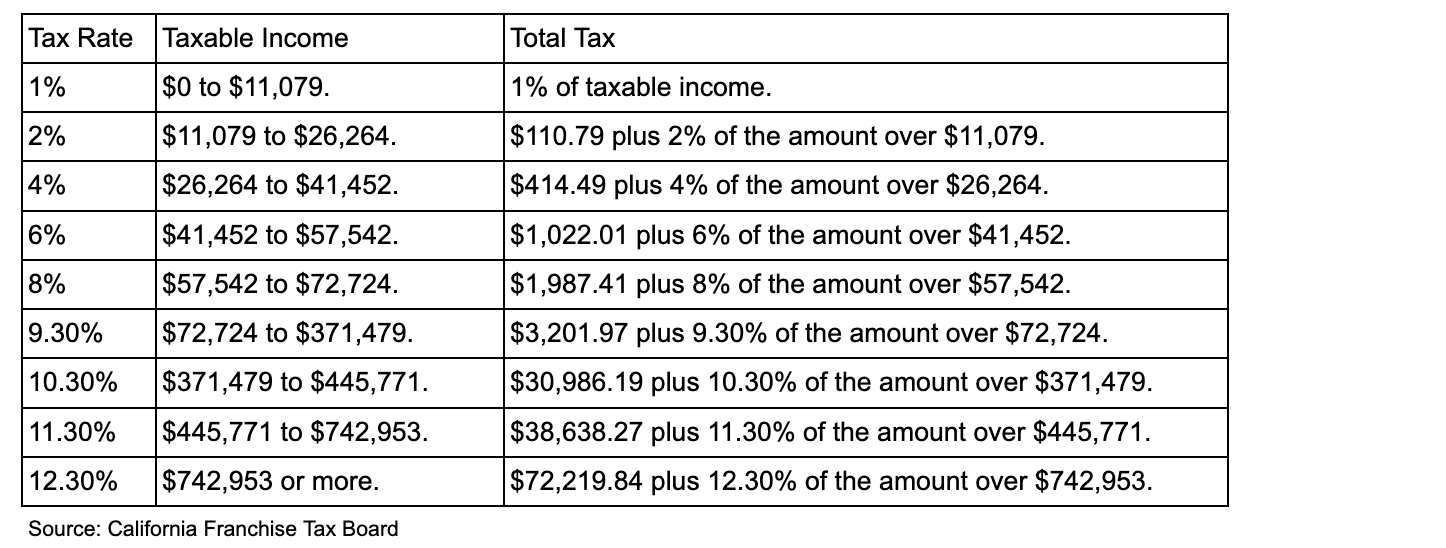

Single Filers | 2025

The Standard deduction for single filers is $15,750 federal and $5,706 for California.

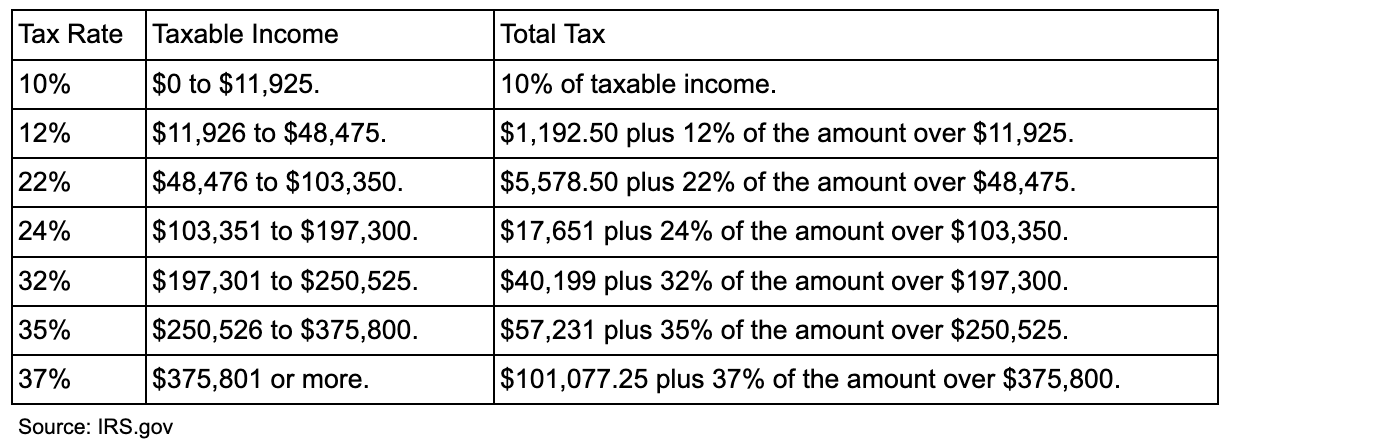

Federal:

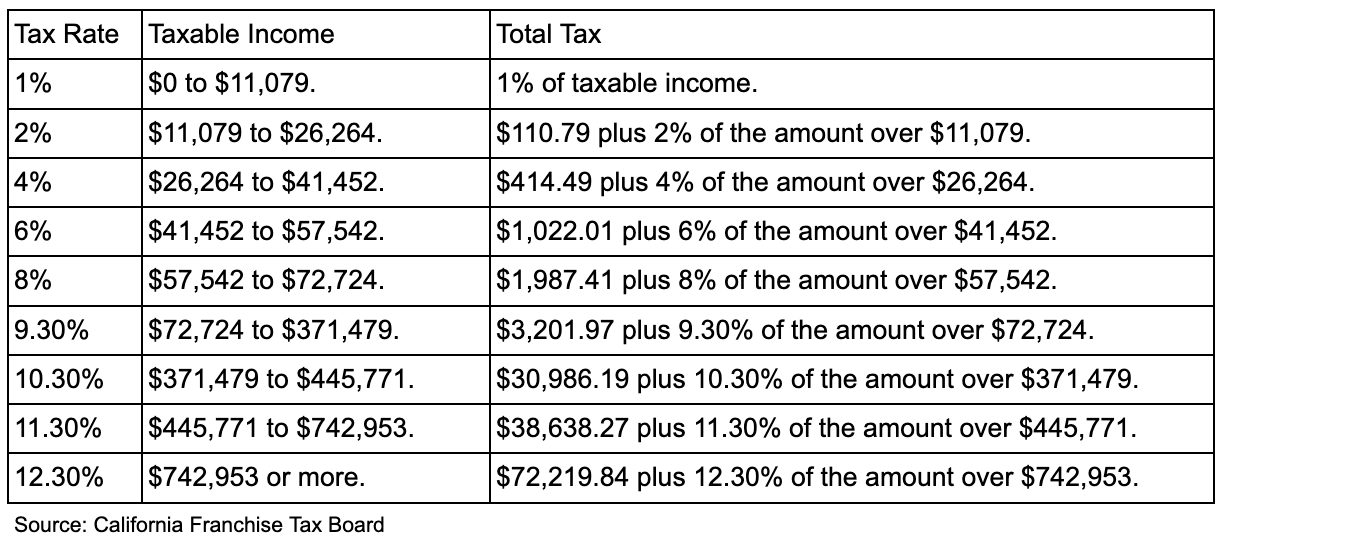

California:

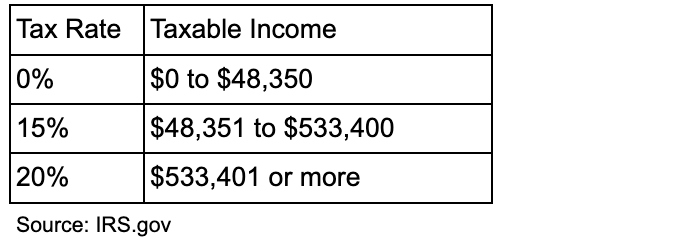

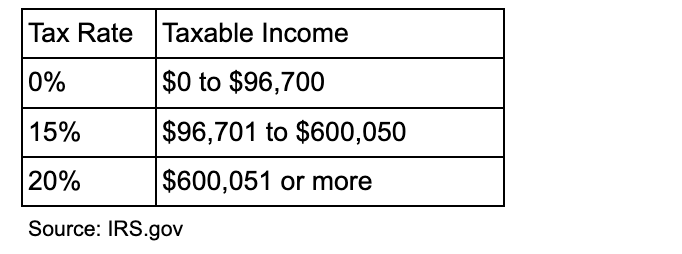

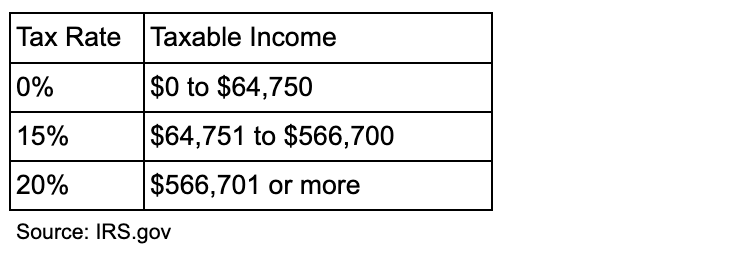

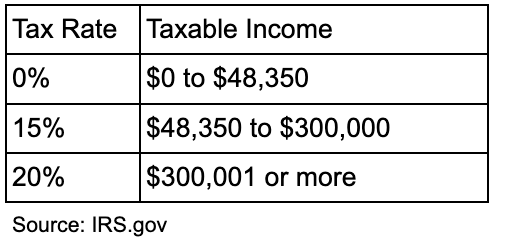

Long-Term Capital Gains

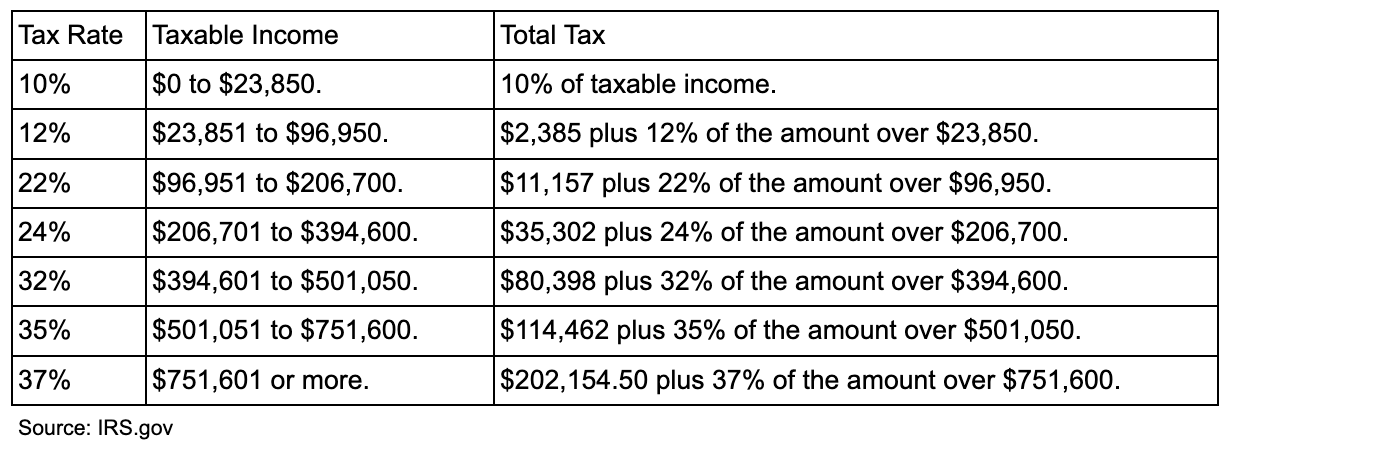

Married, Filing Joint | 2025

The standard deduction for married filing joint filers is $31,500 federal and $11,412 for California.

Federal:

California:

Long-Term Capital Gains

Head of Household | 2025

The standard deduction for head of household filers is $23,625 federal and $11,412 for California.

Federal:

California:

Long-Term Capital Gains

Married Filing Separate | 2025

The Standard deduction for married filing separate filers is $15,750 federal and $5,706 for California.